“Sulekha /Trusted” indicates that the identity & information of the vendors/services, viz., name, address, contact details, business name has been verified on best effort basis, as existing, based on the documents/information furnished by the vendors/service providers. "Sulekha Trusted Stamp" are also allocated to the vendors/service providers considering user's reviews/ratings or any other criteria.

Sulekha strongly recommends to its users/callers to verify all relevant details of vendors/services before availing any products/services from them. Sulekha does not implicitly or explicitly endorse any product/s or services provided by the vendors/service providers.

The Sulekha Verified status confirms that a business's name, address, and contact details were accurate at the time of registration, based on submitted documents or call details. We recommend users exercise caution and conduct due diligence before using any services. Sulekha does not endorse any offerings from advertisers or service providers. For more information, please refer to our Terms and Conditions.

Lonestar Consulting Group

-

15 Years in Business

- Financial Services Avg - $283

- Pricing Avg - $283

Neighborhoods:Valley Vistas, Abbott Loop, Airport Heights, Basher

From the Business:S K C CPA LLC, a CPA firm providing accounting, book keeping services, tax preparation, payroll, auditing, business valuation and entity selection services.As your business partner, we will work with your business in building customized solutions matching your business needs. We are a fast growing business services company specializing in tax, payroll, business formation & business valuation. We serve businesses and individuals. Get your taxes done by qualified, reliable and trustworthy professionals and get an offer if you sign up today. Effective tax preparation and planning can help you to minimize your future tax liability. We can help you proactively manage both your personal and your business tax issues, including understanding how upcoming business opportunities impact your tax status and vice versa. Not all tax planning opportunities are readily apparent. By having us on your team, you are more likely to benefit from those opportunities. We understand how the latest federal, state and local tax legislation and other developments affect you and your business and we are constantly identifying new ways to reduce federal, state or local tax liabilities.Read more

NSKT Global

-

15 years in Business

- CPA Services Avg - $249

Neighborhoods:Financial District, Abbott Loop, Airport Heights, Basher

From the Business:Master Your Taxes and Finances with NSKT Global: Expert Tax Preparation & Accounting Services Navigating the complex world of taxes doesn't have to be stressful. At NSKT Global, we offer comprehensive tax preparation and accounting services designed to simplify your finances, maximize your refunds, and minimize your stress. Led by Certified Tax Preparer Mr. Nikhil Mahajan and a team of experienced Enrolled Agents, we provide a personalized and reliable approach to all your individual and business tax needs. Here's how we can help you: Individuals: Stress-free Tax Preparation: We handle all types of individual tax returns, including Form 1040, 1040 NR, and state returns. Expert IRS Audit Support: Feeling overwhelmed by an IRS audit? Our team has the expertise to guide you through the process and protect your best interests. Strategic Tax Planning: Proactive planning helps you minimize your tax burden and maximize your wealth potential. Tax Advisory Services: Receive tailored advice on complex tax situations, investments, and retirement planning. Businesses: Partnership, S-Corp, C-Corp, and LLC Tax Returns: Our team is licensed to file Form 1120S, 1120, and 1065 for various business structures. Accounting and Bookkeeping Services: Stay organized and compliant with our comprehensive accounting solutions. Business Consulting: Receive expert guidance on tax implications, financial strategies, and growth opportunities. Why Choose NSKT Global? Experience & Expertise: Led by Mr. Nikhil Mahajan and a team of qualified professionals. Personalized Service: We take the time to understand your unique needs and goals. Technology-Driven: Utilize innovative tools for efficient and secure data management. Competitive Rates: Transparent pricing and flexible payment options. Nationwide Coverage: We serve clients in NY, NJ, CA, FL, IL, MA, PA, Washington, Boston, RI, and many other states. Don't let taxes get in the way of your success. Contact Us NowRead more

PAY Financial Service

-

16 Years in Business

-

Language:English , Urdu +2 more

Neighborhoods:Tottenville, Abbott Loop, Airport Heights, Basher

From the Business:PAY Financial Services is one stop for all your accounting, taxation and financial consulting services with over 20 years’ experience. We are a full range financial services company providing incorporation, book keeping & accounting, costing, payroll processing, tax preparation, cash flow, budgeting, compilation and finance consulting. We cater to a wide variety of clients ranging from small to medium sized corporations to individuals. We are committed to provide a complete range of quality service on timely basis at affordable price. Read more

Alam One Stop Tax And Accounting Services INC

-

20 Years in Business

-

Language:Urdu , Bengali +2 more

Neighborhoods:Guadalupe River Trail, Abbott Loop, Airport Heights, Basher

From the Business:Alam One Stop Tax and Accounting Services in San Jose, CA offers a variety of financial services to make your life easier. We provide Tax Preparation and Accounting Services. Tax firm owned by Mahbub Alam.Services offered include: Bookkeeping, Payroll Preparation, IRS Representation, Tax Preparation, Sales Tax Preparation & H-1B Visa Preparation. At Alam One Stop Tax and Accounting Services, we take pride in providing the San Jose community with trusted, professional tax, accounting, and payroll solutions. Since our establishment in 2015, we’ve built a reputation as one of the most reliable accounting firms in the area. Locally owned and operated, we have dedicated ourselves to making tax season, payroll management, and financial planning as stress-free as possible for individuals and businesses alike.With over a decade of experience, we’ve seen firsthand how overwhelming managing financial obligations can be. That’s why we believe in a team approach, working closely with our clients to ensure their financial health is properly managed. Our knowledgeable team combines years of experience and diverse backgrounds to deliver a comprehensive suite of services. Whether you’re filing taxes for the first time, running a business, or need ongoing payroll support, Alam One Stop Tax and Accounting Services is here to help.At Alam One Stop, we understand that navigating financial services can feel overwhelming. That’s why we approach each client with understanding, providing customized solutions that are specific to your unique financial situation. We’re not just about numbers; we’re about people and their long-term success. We invite you to discover the power of our services and experience how we can make your financial world easier to manage.Read more

Northeast Solution CPA

-

15 Years in Business

-

Language:English

Neighborhoods:Tottenville, Abbott Loop, Airport Heights, Basher

From the Business:Deepak Malhotra is a Certified Public Accountant (CPA) practice based in Edison, New Jersey. Deepak Malhotra can assist you with your tax preparation, planning, bookkeeping, and accounting needs. He is an IRS registered tax preparer in Edison, New Jersey. If you are a taxpayer or a small business owner and looking for some assistance in tax filing preparation then Deepak Malhotra can be of assistance to you. For more details contact him. We use unique approach to identify the areas where planning is required to save taxes. We plan for your future by advising you best way to manage money and grow your wealth in tax efficient manner.Read more

Raman Abrol CPA

-

16 Years in Business

-

Language:English

Neighborhoods:Abbott Loop, Airport Heights, Basher, Bayshore/Klatt

From the Business:If you are looking for an accounting firm that will cater to your needs then you have come to the right place. We know that what works for one client-be it a small business or an individual-is not necessarily the solution for another. Our firm is one of the leading firms in the area. By combining our expertise, experience and competence of our staff, each client receives close personal and professional attention. Our firm’s reputation reflects the high standards we demand of ourselves. Please, feel free to browse our website to see the services we offer as well as the many helpful resources we provide. Leave the number crunching to us. When you are ready to learn more about what we can do for you, we encourage you to contact us for a FREE, no obligation consultation.Read more

SK Tax Associates

-

Established Since 2014

Neighborhoods:Abbott Loop, Airport Heights, Basher, Bayshore/Klatt

From the Business:We are a full-service Accounting firm licensed in IL. We provide best bookkeeping services. We offer a broad range of services for business owners, executives, and independent professionals. We are affordable, experienced, and friendly. Read more

NRI Tax Group

-

15 Years in Business

-

Language:English , Punjabi +1 more

Neighborhoods:Forest - Pruneridge, Abbott Loop, Airport Heights, Basher

From the Business:NRI Tax Group provide clients and potential clients with information concerning our firm and our unique, low-pressure approach to personal and professional services. We have an excellent client-retention rate, and we are extremely proud of the high-quality services that our firm provides.Read more

WhizHub Taxes TAX ITIN FBAR STIMULUS

-

15 Years in Business

-

Language:English

- ITIN application for all dependents & FBAR reporting

Neighborhoods:Abbott Loop, Airport Heights, Basher, Bayshore/Klatt

From the Business:Once again, tax season is here! and WhizHub will be pleased to invite you, to have your tax return prepared by our professional employees. Our mandate is to provide quality service at a fair price. We are also committed to be accessible to you for any questions that you may have thereafter. We are open year around to meet these goals.We are IRS authorized E-file provider and ITIN Acceptance agent and specialize in personal taxes and ITIN applications. Thank you for the opportunity and the privilege to introduce the services offered by us:--Free Refund Estimate with pre-filing consultation.-ITIN Applications for all dependents.-H1B, L1/L2 and STUDENT Tax preparation.-Competitive rates with post-filing follow up until refund is deposited.-Year round services include Change of Address, Amendment to prior and current year tax return etc.-Federal and multiple state E-filing.-Itemized return ( Housing loans, medical,charity and much more).-FBAR Reporting.Read more

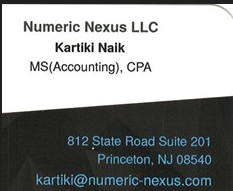

Numeric Nexus LLC

-

15 Years in Business

Neighborhoods:Abbott Loop, Airport Heights, Basher, Bayshore/Klatt

From the Business:We are one of the most distinguished Financial & Taxation Services in Princeton, NJ. We specialize in Accountant Services, Bookkeeping, Business Entity Selection, Financial statement Analysis, Foreign Accounts Disclosure, Income Tax Filing, Income Tax Preparation, Incorporation Service, International Tax Consulting, Payroll Processing, Personal Tax Planning, Tax Consultants Services, Tax Preparation ServicesRead more

My Tax Filer - Pleasanton

-

16 Years in Business

-

Claimed

-

Closed now

-

Language:English , Hindi

From the Business:MyTaxFiler® provides you with top-quality tax and consulting services, so you are free to shine at what you do best - manage your business. From income tax solutions, business formation payroll processing to business consulting and corporate taxation services, MyTaxFiler® offers end-to-end financial solutions for businesses and individuals in the United States. We run on a foundation of integrity and trust, with a commitment to customer service and quality. We make it our aim to be accessible, efficient, and responsive, technologically sophisticated and maintain the highest standards of professional service. We offer end-to-end financial solutions for businesses and individuals in the United States, offering everything from business formation, bookkeeping, record keeping, payroll processing, and income tax filings. Our tax, finance, and account specialists offer you the security and process advantages of a large company, with the personalized service and quality standards of a savvy boutique firm. With the vast experience of our management team, MyTaxFiler® has developed a strong client base who rely on our knowledge and expertise.Read more

Ram Associates CPA

-

Established Since 1983

-

Claimed

-

Closed now

From the Business:We can replace your back office with accounting, payroll, and bookkeeping support. When it comes to complex issues, rely on us. We developed strategies for both business and individual clients. And we work hard and long hours when they need us - even after tax season. So let us tackle your most pressing financial issues. We’re dedicated to our clients. And we've represented them in audits with the IRS, FTB, and EDD. This keeps us current on tax law so we’re always ready for the toughest situations. Read more

Ratings & Reviews for Foreign Accounts Disclosure

I worked with them in 2023, they are very efficient and patiently responded to my questions. I am planning to work with them in the coming years as well

I've had the pleasure of working with Giri Lankipalle for my financial services needs, and I couldn't be more impressed! Giri's expertise, guidance, and personalized approach have helped me achieve my financial goals. His ability to break down complex financial concepts into understandable terms is exceptional. Giri's passion for delivering top-notch service is evident in every interaction. I highly recommend Giri Lankipalle for all your financial services needs. You won't be disappointed.

Everything You Need to Know About Financial & Taxation Services

Understanding Taxes on 401(k) Distributions: What You Need to Know

401(k) distributions refer to withdrawing funds from your retirement account, with tax implications based on timing and method. Standard withdrawals after age 59½ are taxed as ordinary income, while early withdrawals may incur a 10% penalty plus taxes. Rolling over to another retirement plan can avoid immediate tax consequences. It's essential to plan distributions, understand exceptions, and consult professionals to manage taxes effectively.

What a TikTok Ban Could Mean for Business Taxes and Compliance!

Navigating the tax and compliance implications of a TikTok ban requires proactive planning and expert support. Businesses are encouraged to consult finance and taxation professionals to maximize deductions, ensure compliance, and develop sustainable strategies for future growth. These experts can provide tailored advice to help businesses transition smoothly and stay competitive in an evolving digital landscape.

Understanding the Decline in Your Tax Refund This Year

Why Tax Refunds Are Lower This Year Many taxpayers in the USA and Canada have noticed a significant drop in their tax refunds in 2024. This trend can be attributed to several factors, including changes in tax laws, adjustments in withholding, and the expiration of pandemic-related tax benefits.

Understanding the Child Tax Credit: Maximizing Your Benefits

What is the Child Tax Credit? The Child Tax Credit (CTC) is a U.S. tax benefit that helps families manage the financial responsibilities of raising children. It reduces tax liability for eligible parents and offers partial refunds even if no taxes are owed. To qualify, the child must meet specific criteria, including age, relationship, residency, and citizenship. The credit supports essential expenses like childcare and education, providing financial relief and stability for families.

How Global Events Like the Ukraine Conflict Affect Your Investments and Taxes

International conflicts can have far-reaching consequences, not just on geopolitics but also on the global economy. The ongoing situation in Ukraine serves as a stark reminder of how these events can influence taxation and investment landscapes, creating challenges and opportunities for individuals and businesses alike.

Understanding Self-Employment Taxes: A Comprehensive Guide

What is Self-Employment Tax? Self-employment tax is a critical aspect of managing your finances as a self-employed individual. Unlike traditional W-2 employees, self-employed individuals must handle their own Social Security and Medicare taxes, collectively known as self-employment tax. This tax ensures that self-employed workers contribute to these essential programs. How much is Self-Employment Tax?

Why Filing Taxes Isn’t Just a Responsibility—It’s a Power Move!

Let’s face it: nobody jumps out of bed yelling “Yay! It’s tax season!” (unless you’re a CMA with a caffeine addiction). For most of us, taxes are more like that distant cousin you only remember when they show up — demanding attention, documents, and deadlines.

How to Spot a Great Finance & Tax Expert in the U.S. (Even If You Slept Through Math Class)

So, taxes are due, deductions look like gibberish, and financial jargon makes you want to run. You tell yourself, “I’ll Google it” — but 3 tabs later, you’re watching cat videos and forgetting what HRA even means. Enter: The Finance & Tax Expert — your budget’s best friend and confusion’s worst enemy. But how do you know who’s good?

FAQ of Foreign Accounts Disclosure

- Why should I hire a professional CPA to prepare my tax return?

Certified Public Accountants (CPAs) pass an extensive, two-day examination on accounting, auditing, taxation, and business law. They maintain their licenses by taking ongoing classes. CPAs have a depth and breadth of knowledge that most tax professionals do not. Hiring a CPA through Sulekha Financial Taxation Services ensures you have an expert with comprehensive knowledge and up-to-date information on tax laws and regulations.

- How often should bookkeeping be performed?

Generally, bookkeeping is performed once per month. However, the frequency can vary depending on the size and needs of your business. New businesses with limited transactions might only need quarterly bookkeeping, while larger businesses with more frequent transactions might need it more often. Regular bookkeeping through Sulekha Financial Taxation Services ensures accurate financial records, aiding in better financial decision-making and compliance.

- What is tax planning and why is it important?

Tax planning involves analyzing your financial situation to ensure tax efficiency, minimizing tax liability through strategies such as timing of income, purchases, and investments, and leveraging tax deductions and credits. It is important because it helps minimize tax liabilities, maximizes savings, and ensures compliance with tax laws. Effective tax planning with Sulekha Financial Taxation Services can also help in avoiding penalties and interest charges.

- How can I minimize my tax liability?

Strategies to minimize tax liability include taking advantage of deductions and credits, deferring income, maximizing retirement contributions, utilizing tax-advantaged accounts, and seeking professional tax advice for effective tax planning. Implementing these strategies with the help of Sulekha Financial Taxation Services can significantly reduce the amount of tax you owe, allowing you to retain more of your earnings.

- What are the different types of tax returns?

The main types of tax returns include: Individual Income Tax Returns (Form 1040): Filed by individuals to report their income, deductions, and credits. Corporate Tax Returns (Form 1120): Filed by corporations to report income, gains, losses, deductions, and credits. Partnership Tax Returns (Form 1065): Filed by partnerships to report income, deductions, and credits, with income passed through to partners. S-Corporation Tax Returns (Form 1120S): Filed by S-Corporations to report income, gains, losses, deductions, and credits, with income passed through to shareholders. Estate/Trust Tax Returns (Form 1041): Filed by estates and trusts to report income, deductions, and credits.

- What is the difference between tax deductions and tax credits?

Tax deductions reduce your taxable income, thus lowering your overall tax liability based on your marginal tax rate. Examples include mortgage interest, medical expenses, and charitable contributions. Tax credits provide a dollar-for-dollar reduction in your tax liability, significantly reducing the amount of tax owed. Examples include the Earned Income Tax Credit (EITC) and Child Tax Credit. Sulekha Financial Taxation Services can help you identify and maximize these deductions and credits.

- How do I handle back taxes?

Handling back taxes involves filing any past-due tax returns, paying the owed amount, and potentially setting up a payment plan with the IRS. Sulekha Financial Taxation Services can assist in negotiating payment plans and exploring options like offers in compromise. Addressing back taxes promptly can help avoid additional penalties and interest charges.

- Can financial taxation services help with IRS audits?

Yes, Sulekha Financial Taxation Services can assist with IRS audits by providing representation, preparing necessary documentation, and offering guidance to ensure compliance with IRS requirements and reduce potential liabilities. Our professionals are experienced in handling audits and can help navigate the process efficiently.

- What is the Alternative Minimum Tax (AMT)?

The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that high-income individuals and corporations pay a minimum amount of tax, even if they qualify for various deductions and credits under the regular tax system. Sulekha Financial Taxation Services can help you understand if the AMT applies to you and how to manage its impact on your tax liability.

- What is a tax extension, and how do I apply for one?

A tax extension provides additional time to file your tax return (typically six months) but does not extend the time to pay any taxes owed. You can apply for an extension using IRS Form 4868 for individuals or Form 7004 for businesses. Sulekha Financial Taxation Services can assist you in filing for an extension and ensuring all necessary forms are completed accurately.

- What are quarterly tax payments, and who needs to make them?

Quarterly tax payments are estimated tax payments made four times a year by individuals and businesses with income not subject to withholding, such as self-employment income, rental income, or investment income. Making these payments helps avoid penalties for underpayment of taxes. Sulekha Financial Taxation Services can help you determine your estimated tax payments and ensure they are made on time.

- What is tax loss harvesting?

Tax loss harvesting is a strategy to offset capital gains by selling securities at a loss. These losses can be used to reduce taxable capital gains and potentially offset up to $3,000 of ordinary income per year. Sulekha Financial Taxation Services can help you implement tax loss harvesting strategies to minimize your tax liability.

- What are the benefits of electronic tax filing (e-filing)?

Benefits of e-filing include faster processing of tax returns, quicker refunds, reduced errors, secure submission, and immediate confirmation of receipt by the IRS. Sulekha Financial Taxation Services offers e-filing options to make your tax filing process more efficient and hassle-free.

- Can I amend a tax return after it has been filed?

Yes, you can amend a tax return if you need to correct errors or make changes. This is done by filing IRS Form 1040-X. Sulekha Financial Taxation Services can assist with this process to ensure accuracy and compliance, helping you make the necessary corrections to your previously filed returns.

- What is the Earned Income Tax Credit (EITC)?

The Earned Income Tax Credit (EITC) is a refundable tax credit for low to moderate-income working individuals and families. The amount of the credit depends on income, filing status, and number of qualifying children. Sulekha Financial Taxation Services can help you determine your eligibility for the EITC and assist in claiming this valuable credit.

- How do I choose the right tax professional?

Choosing the right tax professional involves considering their qualifications (such as CPA, EA, or tax attorney), experience, reputation, fees, and whether they specialize in your specific tax situation. Sulekha Financial Taxation Services connects you with qualified and experienced tax professionals who can provide tailored advice and services to meet your needs.

- Can financial taxation services help with international tax issues?

Yes, Sulekha Financial Taxation Services can assist with international tax issues, including compliance with foreign tax laws, reporting foreign income, navigating tax treaties, and addressing expatriate tax concerns. Our experts are well-versed in international tax regulations and can help you manage your global tax obligations effectively.