“Sulekha /Trusted” indicates that the identity & information of the vendors/services, viz., name, address, contact details, business name has been verified on best effort basis, as existing, based on the documents/information furnished by the vendors/service providers. "Sulekha Trusted Stamp" are also allocated to the vendors/service providers considering user's reviews/ratings or any other criteria.

Sulekha strongly recommends to its users/callers to verify all relevant details of vendors/services before availing any products/services from them. Sulekha does not implicitly or explicitly endorse any product/s or services provided by the vendors/service providers.

The Sulekha Verified status confirms that a business's name, address, and contact details were accurate at the time of registration, based on submitted documents or call details. We recommend users exercise caution and conduct due diligence before using any services. Sulekha does not endorse any offerings from advertisers or service providers. For more information, please refer to our Terms and Conditions.

Samatva Wealth Management LLC

-

Established Since 2007

-

Language:English

Neighborhoods:North Frederick Avenue/Hechinger/Mardirossian, Abbott Loop, Airport Heights, Basher

From the Business:We provide tax, financial consulting services asset and retirement portfolio planning and management services to individuals, Family and businesses. We are dedicated to providing individuals and other types of clients with a wide array of investment advisory services. We shall provide investment education to plan participants regarding the selection of Model Portfolios, and will survey each plan participant to assess.Read more

Manage My Taxes Inc - Pay Less Taxes Legally

-

Established Since 1980

- ITIN Acceptance Agent, W7 Application, Not

Neighborhoods:Sunnybrook Farms, Abbott Loop, Airport Heights, Basher

From the Business:MMTi provides Online Tax Preparation, one-on-one Professional Tax Preparation, Tax Review, Electronic Filing, Audit Assistance, Payroll Services, Small Business Consulting & Incorporation services. MMTI™ has partnered with Drake Software's 1040.com to provide you the highest quality, comprehensive and one of the most affordable online tax preparation & e-file services. We always ensure that your filing status results in the lowest possible tax possible.Read more

Inderpreet Singh- Certified Public Accountant NYC

-

Established Since 2018

-

Language:English , Punjabi +2 more

- Trucking Services(IFTA,USDOT, MC)

From the Business:Inderpreet Singh CPA PLLC has 15 years of accounting & taxation experience. Industries audited/worked include individual taxation, corporate taxation, financial consulting, technology, buy & sell-side finance, biotech, retail analysis, cryptocurrency, real estate accounting, and manufacturing. Inderpreet Singh CPA licensed with the New York State Association of Certified Public Accountants and has taught advanced Accounting at top-tier universities since 2016. As a former Revenue Agent, as well as a former Appeals Officer, Inderpreet's 15 years of experience working with the IRS provides clients the assurance that their reporting requirements meet the strictest standards. And when representation is needed before the IRS or NY State taxing authorities, Inderpreet's experience makes him eminently qualified to defend even the most complex cases and tax positions.Read more

Everything You Need to Know About Financial & Taxation Services

How Much Do Accountants Charge in 2025?

How Much Do Accountants Charge in 2025? When it comes to managing taxes, bookkeeping, or financial reporting, one of the most common questions people ask is: “How much do accountants charge in 2025?” Whether you’re a small business owner, freelancer, or corporate professional, understanding accounting fees in advance can help you plan your finances and choose the right CPA or accounting firm.

What is Payroll processing? - Basics, Process, Compliances and Methods

Payroll processing is an essential function in any business

Smart Moves, Big Savings: Why Personal Tax Planning Matters More Than Ever

Let’s face it — taxes aren’t exactly thrilling. But saving money? Now that’s exciting. Personal tax planning isn’t just for the wealthy or the finance-savvy. It’s for anyone who wants to keep more of what they earn and avoid last-minute filing stress. What Is Personal Tax Planning? Personal tax planning is all about organising your finances

What are the steps in payroll processing? A Complete Guide for Businesses

What are the steps in payroll processing? A Complete Guide for Businesses Payroll processing is a critical task every business must handle accurately and efficiently to ensure employees are paid on time and the company stays compliant with tax regulations. Understanding the steps involved can help business owners streamline the process, reduce errors, and avoid penalties. Step 1: Collect Employee Information

Money Talks—But Are You Listening? Why Financial Planning Isn’t Just for the Rich

Let’s bust a myth right now: financial planning isn’t just for millionaires. It’s for anyone who wants to stop living paycheck to paycheck, retire without panic, or simply make smarter money moves. Whether you're a salaried professional, a small business owner, or a freelancer juggling invoices and chai breaks—your money deserves a plan. And that’s where financial experts come in.

What Are the Basic Principles of Bookkeeping?

Keep your finances clean, clear, and compliant with the right bookkeeping foundation. Bookkeeping is the backbone of any successful business. Whether you're a small business owner or managing a growing enterprise, understanding the basic principles of bookkeeping helps you make smarter financial

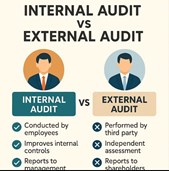

What Are the Key Differences, Pros, and Cons of Internal Audit Versus External Audit?

What Are the Key Differences, Pros, and Cons of Internal Audit Versus External Audit?

How to Calculate Quarterly Estimated Taxes for 2025

How to Calculate Quarterly Estimated Taxes for 2025 If you’re self-employed, own a small business, or have income without automatic tax withholding, making quarterly estimated tax payments in 2025 is a crucial part of staying compliant with IRS rules. Paying taxes throughout the year — instead of waiting until tax season — helps avoid large tax bills and underpayment penalties.