“Sulekha /Trusted” indicates that the identity & information of the vendors/services, viz., name, address, contact details, business name has been verified on best effort basis, as existing, based on the documents/information furnished by the vendors/service providers. "Sulekha Trusted Stamp" are also allocated to the vendors/service providers considering user's reviews/ratings or any other criteria.

Sulekha strongly recommends to its users/callers to verify all relevant details of vendors/services before availing any products/services from them. Sulekha does not implicitly or explicitly endorse any product/s or services provided by the vendors/service providers.

The Sulekha Verified status confirms that a business's name, address, and contact details were accurate at the time of registration, based on submitted documents or call details. We recommend users exercise caution and conduct due diligence before using any services. Sulekha does not endorse any offerings from advertisers or service providers. For more information, please refer to our Terms and Conditions.

Neighborhoods:Macomb Township, Abberley Towneship, Abbotts Bridge Place, Abbotts Chase

From the Business:We work face-to-face with borrowers to prequalify you, verify the credit and property aspects of the loan, and make sure you are protected in all areas of the transaction. We can help you make sense out of your credit and offer tips on improving it. We understand that your home is likely your biggest investment. Our specialized approach will help you to maximize the returns on your investment, all while minimizing the cost involved. We will help you through the whole process from beginning to end to ensure you have the best experience possible. We insist that all transactions with our customers, associates, vendors, and suppliers meet the highest ethical standards. Our experienced staff will help you choose the right mortgage program- NMLS Read more

CD Mortgage Corp

-

16 Years in Business

- DRE #01014517 NMLS #323411

Neighborhoods:Lacy, Abberley Towneship, Abbotts Bridge Place, Abbotts Chase

From the Business:CD Mortgage Corp is a trusted mortgage lending company committed to helping individuals and families achieve their dream of homeownership. With a focus on personalized service and expert guidance, CD Mortgage Corp offers a wide range of mortgage solutions tailored to fit each client’s unique financial situation and goals. Whether you are a first-time homebuyer, looking to refinance, or interested in investment properties, their experienced team is dedicated to making the mortgage process smooth and stress-free. At CD Mortgage Corp, customer satisfaction is paramount. They work closely with clients to understand their needs, provide clear explanations of available options, and help secure competitive rates. Their transparent approach ensures clients feel confident and informed every step of the way. By leveraging strong industry relationships and innovative technology, CD Mortgage Corp can deliver fast approvals and efficient closings. The company’s commitment extends beyond just financing—they strive to build lasting relationships and support clients through every phase of their homeownership journey. With CD Mortgage Corp, you gain a reliable partner focused on turning your real estate goals into reality. Whether buying your first home or upgrading to a new one, CD Mortgage Corp is here to provide expert advice and customized mortgage solutions designed for your success.Read more

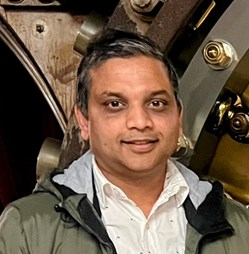

Gaurav Vaish Loan Advisor NMLS# 2122782

-

5 Years in Business

- 2122782

Neighborhoods:Abberley Towneship, Abbotts Bridge Place, Abbotts Chase, Abbotts Cove

From the Business:Looking to buy your dream home or refinance with ease? Connect with Gaurav Vaish, a reliable and knowledgeable mortgage loan advisor helping families and individuals across the Bay Area. With personalized guidance, competitive rates, and a deep understanding of the mortgage process, Gaurav ensures a smooth experience from application to closing.Read more

Ensure Home Loans LLC

-

4 Years in Business

-

Claimed

-

Open 24hrs

-

Language:English , Hindi +7 more

- #1666674

Neighborhoods:Huntington Estates

From the Business:We are looking for loan officers and adding new loan originators for Ensure Home Loans has the solution for any type of residential loan - Conventional, NON-QM, Jumbo, ARM, Bank Statement Loan, DSCR Loan, Hard Money Loan, Foreign National Loan, and Construction Loan. Ensure Home Loans serves 23 states. They include Texas, California, Arizona, Washington, Colorado, Oregon, Florida, Tennessee, North Carolina, and South Carolina. Georgia, Kansas, Arkansas, Michigan, DC, Wisconsin, Illinois, Indiana, New Jersey, Connecticut, Oklahoma, and MinnesotaRead more

Mohan Daggubati Loan Officer & Realtor.

-

5 Years in Business

-

Claimed

-

Language:English , Hindi

- $235k-$1163k

- Active Listings Avg - $375000

- Sold Out Avg - $597620

From the Business:I am one of the most distinguished Loan Services in Charlotte, NC. I specialize in Mortgage Loan Services,Business Loan Services,Home Loan Services,Commercial Loan Services,Residential Loan Services.Read more

RAMaswamy Selvaraju (#1 Loan Officer) NMLS #2493764

-

3 Years in Business

-

Claimed

From the Business:I am one of the most distinguished Loan Services in Dallas, TX. I specialize in Mortgage Loan Services,Business Loan Services,Home Loan Services,Personal Loan Services,Residential Loan Services.Read more

From the Business:Our quick and easy loan process at K Solutions Inc in Nutley, NJ is what separates our business from our competitors. We specialize in offering business loans to small and mid-size businesses.We finance: Gas stations, Liquor Stores,Motels, Hotels, Franchises, Bowling Alleys, Pharmacy, Strip Malls, Apartment Buildings, Shopping Center, Donut Shops and many more.Read more

From the Business:I specialize in Startup & Business Funding, Business Equipment Finance, Business Cash Advance, Term Loans, Lines of Credit.Read more

Ratings & Reviews for Business Loan Services

Gaurav is an amazing person to work with. He helped me get my first home, much before the 30 day contract deadline

have closed my home last week, and it went all smooth on the mortgage part, thanks to Sai! I will recommend Sai to everyone in the market looking to buy a home or even for refinance. You can talk to different lenders and decide, I did the same. I talked to different lenders, including Jim/Chip Bartels; amazingly, Sai's terms and interest rates beat them by a huge margin! And my closing costs are amazingly low (Low as in you will save around $4000). Working with Sai was very pleasant; he provided me with all information needed upfront so the process started fast, and he answered all the questions patiently. Since I am a first-time homebuyer, I did not understand the process and asked questions repeatedly, which he answered patiently as it was the first time. He is very professional and keeps you updated with what comes next so you would be ready and prepared. Thanks, Sai, for helping me with my lending needs in this tough time and finishing it so perfectly.

Absolutely top-notch. I was nervous about buying during a competitive market, but CD Mortgage Corp kept me confident and informed. They truly care about their clients

- Great team, appreciate timely inputs,very responsive. Closed in 15 days.thanks again

Everything You Need to Know About Loan Services

How to Improve Your Credit Score before Applying for a Loan

Hey there, future borrowers! If you’re thinking about applying for a loan, one of the first things you should check is your credit score. Your credit score is like your financial report card—it tells lenders how responsible you are with credit. A higher score can mean better loan terms and lower interest rates, so let’s dive into some easy ways to boost that score before you apply! 1. Check Your Credit Report

The Hidden Costs of Loans in New York City: What You Need to Know Before You Borrow

When you're in the hustle and bustle of New York City, borrowing money might seem like a necessary step to keep up with the high cost of living. However, loans come with hidden costs that can quickly turn your financial plans upside down. Understanding these costs before you borrow is crucial to making informed decisions. 1. Interest Rates: The Obvious Yet Overlooked Cost

How to improve your credit score before applying for a mortgage loan

Buying a home is one of the most significant financial decisions you'll ever make, and securing a mortgage loan

Things to note while opting for a Mortgage Loan

A mortgage loan allows you to borrow money to buy or refinance a property, such as a house, a flat, or a land. The property serves as collateral or a security for the loan, which means that if you fail to repay the loan, the lender can take possession of the property and sell it to recover the money.

The Role of Sulekha in Simplifying Your Home Loan Journey

Buying a home is one of life's most essential and exciting decisions. It is also a significant financial commitment that requires careful planning and research. However, finding and applying for the best home loan can be daunting and time-consuming, especially if you are unfamiliar with the various options and requirements.

10 Tips to Secure the Best Mortgage Loan Rates in 2024

Buying a home is a significant milestone, and securing the best mortgage loan rates can make a huge difference in your financial journey. Here are ten tips to help you get the best rates in 2024. Check Your Credit Score

Understanding Interest Rates: How to Get the Best Deal from Loan Companies

If you are looking for a loan, whether it is for personal, business, or any other purpose, one of the most important factors to consider is the interest rate. The interest rate is the percentage of the principal amount the lender charges you for using their money. The higher the interest rate, the more you have to pay back, and the more expensive the loan becomes.

How to Choose the Right Loan for Your Financial Goals in San Francisco: A Comprehensive Guide

Are you a San Francisco resident looking to achieve your financial goals through a loan? With numerous loan options available, selecting the right one can be overwhelming. In this guide, we'll walk you through the thriving finance scene of San Francisco and the process of choosing the perfect loan to suit your needs. San Francisco's Thriving Finance Scene